iowa lottery tax calculator

By law prizes of more than 600 will face a 5 percent state withholding tax. 25 State Tax.

Scramble For Lottery Tickets As Powerball Jackpot Hits 415 Million Powerball Jackpot Lottery Tickets

However for the activities listed below winnings over 5000 will be subject to income tax withholding.

. Players should report winnings that are. The Iowa Lottery does not withhold tax for prizes of 600 or less. Lottery Calculator provides Federal and statelocal taxes and payout after Powerball Mega Millions winning.

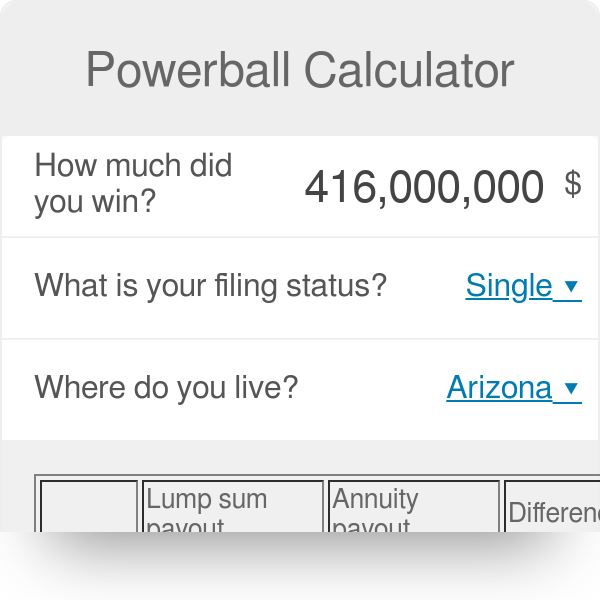

You may then be eligible for a refund or have to pay more. Using the lottery annuity payout calculator you can see the estimated value of the different payout installments for each year. Jackpot size If you won a huge lottery prize enter the exact sum here.

That means your winnings are taxed the same as your wages or salary. Although it sounds like the full lottery taxes applied to players in the. Tuesday Jun 14 2022.

Iowa lottery tax calculator Tuesday February 22 2022 Edit. And you must report the entire amount you receive each year on your tax return. Additional tax withheld dependent on the state.

5 Kansas state. If a player wins more than 5000 an. The Lottery Tax Calculator- calculates the tax lump sum annuity payment after lotto or lottery winnings.

The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate. The calculator will display the taxes owed and the net jackpot what you take home after taxes. Gambling winnings are typically subject to a flat 24 tax.

25 State Tax. The state tax on lottery winnings is 34000000000000004 in Indiana which youll have to pay on top of the federal tax of 25. Current Mega Millions Jackpot.

Calculate your lottery lump sum or. The online lottery annuity payout calculator will provide you with 30 different payouts based on the tax laws that apply in your state. Any lottery sweepstakes or.

This also applies to winnings from a multi-state lottery if the tickets were purchased within the state of Iowa. And you must report the entire amount you receive each year on your tax return. You can enter any numeric value making it.

The exact amount depends on the rules of the actual game. That means your winnings are taxed the same as your wages or salary. This varies across states and can range from 0 to more than 8.

For one thing you can use our odds calculator to find the lotteries with the best chances of winning. For example lets say. The Iowa tax that must be withheld is computed and paid under either of the.

Continue surfing free trials beating parking tickets suing robocallers for cash and more. All calculated figures are based on a sole prize winner and factor in an initial 24 federal tax withholding. The Tax Calculator helps you to work out how much cash you will receive on your Lotto America prize once federal and state taxes have been deducted.

You just need to enter details of your. 323 Iowa state tax on lottery winnings in USA. For example lets say you elected to.

This can range from 24 to 37 of your winnings. Imagine having to pay 28 in taxes on your precious lottery winnings. The Iowa Lottery makes every effort to ensure the accuracy of the winning numbers prize payouts and other information posted on the Iowa Lottery website.

First enter the initial jackpot amount. These lottery tools are here to help you make better decisions. Lottery Winning Taxes in India.

SmartAssets Iowa paycheck calculator shows your hourly and salary income after federal state and local taxes. This is equal to a percentage of Iowa taxes paid with rates ranging from. Enter your info to see your take home pay.

A federal tax of 24 percent will be taken from all prizes above 5000 including the jackpot before you receive your prize money. Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact Lottery Tax Rates Vary Greatly By State. Many of Iowas 327 school.

Heres a quick guide on how to use our lottery tax calculator. A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. There might be additional taxes to pay the exact amount of these.

After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax.

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator Updated 2022 Lottery N Go

Usa Lottery Tax Calculators Comparethelotto Com

Powerball How To Calculate The Probability Of Winning Each Prize Youtube

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

How Long After Winning The Lottery Do You Get The Money

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Mega Millions Payout Calculator Charts For After Taxes Oct 23 Heavy Com

Usa Lottery Tax Calculators Comparethelotto Com

Lottery Tax Calculator Updated 2022 Lottery N Go

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

Lotto America Tax Calculator Calculate The Lottery Tax

Budgeting Budgeting Pay Yourself First Making A Budget

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact